#7 What’s a Strategy and How Do I Get One?

Every business that succeeds has developed clear differentiation from every other business that competes for the same customer dollar to solve the same problem – differentiation that customers value. It doesn’t matter if you are a one person shop or a giant multi-national corporation.

So, how could a declining, pure commodity business, flour, in a declining category with a poor market position and cost disadvantage differentiate from competitors and achieve revenue growth of 21%, profit increases of 85%, all while reducing spending … in two years?

declining, pure commodity business, flour, in a declining category with a poor market position and cost disadvantage differentiate from competitors and achieve revenue growth of 21%, profit increases of 85%, all while reducing spending … in two years?

For many, many businesses, this is essentially the challenge they face and the performance they want. Developing a strategy that works is the solution. But what is a strategy and how do I get one?

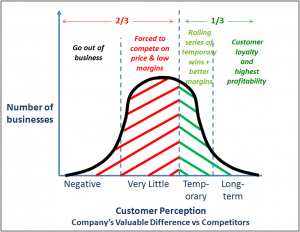

Lack of a compelling difference is the norm.

At least two thirds of businesses have little difference from their competitors.

This is good for customers. Quality is forced to remain high, while price is forced to rock bottom … or further.

And it is a trap that becomes harder and harder to escape.

The business puts more effort in to lowering costs. Investment declines. Innovation declines. There’s a trend toward lower cost people. Best employees leave. Opportunities are chased that stretch resources and dilute focus even more.

Then what happens? Along comes a game changing competitor, with a truly valuable difference, forcing other businesses even further to the left, toward negative territory. Or the big three win, crushing smaller competitors trying to compete on price without any advantage of scale.

The real question is, “Can companies get out of the trap of no or low differentiation, and if so, how?” The answer is, “Yes!” for most businesses. To understand how, it is necessary to understand the three steps of differentiation.

But a note before we go there. A lot of companies confuse go-to-market strategies with their business strategy. A business strategy is how you develop the underlying competitive advantage of your products or services and company. Go-to-market, or marketing and sales strategies, define how you will get and keep your prospective customers attention and com municate your competitive advantage.

municate your competitive advantage.

In real life, Apple’s advantage is innovation. They also have an excellent way to communicate the advantage of that innovation.

The three steps covered here are about business strategy – developing the business advantage that differentiates a business from competitors – that forms the foundation of what you talk about in your marketing and sales.

The Three Steps of Business Strategy

Step 1 – Choose and know your customer.

Businesses must clearly define the customers it wants to serve. Know who they are, where they are, what they want solutions to enable them to do, now and in the future, and why your reason for being resonates with them.

There is a particular perspective that is very helpful: when providing any solution (product/service), understand if your target customers see the solution(s) as:

1) expected of all competitors in your industry (if you don’t perform well on these expectations, providing great value on other issues that can differentiate the business won’t matter). Many businesses continue to focus on improving basics as the basis for differentiation. Over and over again it’s been shown that improving satisfaction with basics past a certain point has no value to the customer.

2) a true value driver – a solution to an issue that is important to customers and the industry has not solved well. These form the core opportunities to differentiate.

3) taking away an irritant. Eventually these may become value drivers, but not yet.

4) a solution to a problem that is unimportant.

You must also understand how customers perceive your business performance on these issues relative to other competitors, and how perceptions change.

Customer’s views of an issue, and your value, change over time: when value driver issues get solved by the majority of the industry, they become basic – expected. And customers are not very good at saying what they want in the future.

This is where a lot of businesses get in trouble, believing their competence in delivering a value driver of the past will continue to generate a valuable difference from competitors in the future. Not so. Expectations and issues change.

And it gets worse. If businesses ask customers if they are satisfied, customers lie about their satisfaction. Of customers who report they are “satisfied” with a product or service, 60% are actively looking for an alternative.

Focus on understanding what your customers are trying to do.

Step 2 – Choose your core differentiation strategy that allows you to create “uncontested market space.”

Choose the one foundational differentiating strategy that you can (or will) do better than any other competitor.

The grand masters of competitive strategy, Michael Porter¹, Michael Treacy and Fred Wiersema², found there are only three core foundational strategies from which to choose. These have truly stood the test of time.

The three are: 1) deliver consistently good quality at the lowest operational cost to the customer (Walmart), 2) deliver highest quality/ innovation solutions to the customer (Tiffany and Apple), or 3) deliver the most customer intimate solution to the customer (customization different for very small groups or individual customers (Amazon).

Many business leaders ask, “Why can’t we pursue more than one?” Great question, because focus on one strategy can lead to advantage in another core strategy. But not because a business is truly able to focus on pursuing two at the same time. Let’s look at an example:

Progressive insurance pursued a core differentiation strategy of service quality and innovation. By focusing on innovative ways to solve a big customer problem: reducing the time the industry took to pay claims. Through innovation they were able to reduce claim payments to customers from 40 days to 1 hour. Adjustors at an accident could offer the customer the choice of receiving a check on the spot or having Progressive take the vehicle to one of their prescreened repair shops for the customer where the repair would be guaranteed.In the process, they dramatically reduced claim fraud, paperwork and repair errors, giving them a cost advantage compared to other insurance companies. They could reflect much of this in price, while still maintaining higher margins than competitors.

They would never have achieved this if they had not single mindedly pursued dramatic improvement in service quality – reducing the time to pay claims from 40 days to 1 hour. Innovation through new technologies, innovation in redesigned roles and responsibilities throughout the claims process, and reinventing how they implemented repairs allowed Progressive, as a byproduct, to also achieve a cost advantage.

Step 3 – Choose your core competencies that allow you to differentiate.

Michel Robert, in Strategy Pure and Simple³, makes the distinction between strategic thinking and strategic planning. Strategic thinking allows a business to choose the one strategic driver or core competency that will enable it to be best in its core differentiating strategy. It’s not easy to choose. Robert does a great job demonstrating there are ten from which to choose³. Great companies choose one to be the driver, and 1-3 others that are supporting competencies.

- Product/Service Driven: Excel in a single product or service class. Requires excellence in product or service innovation. (Boeing – aircraft; Michelin – tires).

- User or Customer Class Driven: Excel in serving a single, well defined set of end users who share multiple needs. Requires excellence in market research about users and the ability to create loyalty through development of many solutions to serve those customers (Johnson & Johnson – doctors, patients, nurses, mothers; AARP – adults over fifty).

- Market Type or Category Driven: Excel in a specific market place or type. Requires excellence in market research about the market and the ability to create loyalty by delivering a wide variety of solutions to serve that market in different ways (Disney – entertainment for families; American Hospital Supply (hospitals).

- Technology Driven: Excel in a basic hard technology or soft technology (know how). Requires excellence in R&D and marketing of technology. (Intel – microchip design and manufacturing; Lean Masters Consulting – lean manufacturing; 3M – polymer chemistry, manufacturing and application).

- Production Capability or Capacity Driven: Excel in production capability or capacity which requires significant investment and which competitors have difficulty duplicating. Requires excellence in manufacturing/plant efficiency and substitute marketing to replace existing vendors (SW Airlines – Low-cost air service substituting for bus service; 3M – Sticky pad manufacturing).

- Distribution Method Driven: Excel in a unique or distinctive approach to moving tangible or intangible things from one place to another. Requires excellence in distribution technologies, processes and innovation. (Walmart – low cost distribution and positioning of consumer products; Twitter – electronic messages; UPS – physical packages.

- Sales or Marketing Driven: Unique or distinctive method of selling to customers. All opportunities it pursues must use this sales/marketing method. (Amazon – on-line shopping; Mary Kay – door to door.)

- Natural Resource Driven: Excel in the discovery and exploitation of a natural resource. (Mosaic – potash; Exxon – oil and gas; DeBeers – diamonds).

- Return or Profit Driven: Excel in maximizing the level of return or profit. Requires excellence in portfolio selection, acquisition, divestiture. (Berkshire Hathaway – investment in multiple unrelated businesses).

- Size or Growth Driven: Excel in driving growth and size for its own sake. Requires excellence in customer acquisition and retention to a specific platform. (Facebook – dominate facilitating friend networks globally; Google – dominate availability of search information.)

Blue Ocean strategies.

The purpose of choosing to focus on a core differentiation strategy and the right strategic drivers is to find a way to compete in uncontested, or at least much less congested, market spaces – what’s been deemed “Blue Ocean.”

The purpose of choosing to focus on a core differentiation strategy and the right strategic drivers is to find a way to compete in uncontested, or at least much less congested, market spaces – what’s been deemed “Blue Ocean.”

Ultimately, the strategy has to be translated into tangible products or services that offer customers what Chan Kim and Renée Mauborgne in Blue Ocean Strategy describe as “exceptional buyer utility⁴.”

There are a number of ways to do this, but the easiest way is to visualize what’s going on competitively to encourage divergent thinking… strategic thinking.

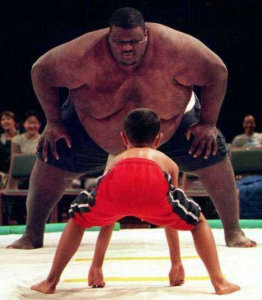

Start by asking, “Are we big or small?

Big players can do things small players cannot, and vice versa. Visualizing what you are up against forces you to ask, “How do I win customers?” You realize the assumed question, “How do I win against a specific competitor by assuming their rules?”, is the wrong one.

Next, map your market.

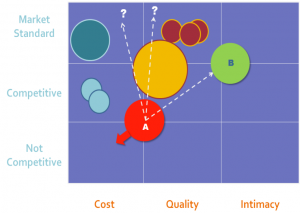

Put yourself, the market’s customer segments, and your competitors on a map of the three core differentiation strategies. See how the size of the players compares. See the relative strength of players in each strategy. Find the open space — see the red oceans and the blue oceans.

See the big picture … not the numbers. Pillsbury’s consumer flour business (red circle) was declining 7% per year in a category declining 5% per year, a pure commodity with zero differentiation, a 15% cost disadvantage, and the #3 or 4 position in most regional markets. By shifting to a customer intimate strategy with the core competence to deliver customized recipes to end-users and customized market data to supermarkets that allowed them to grow the category, two years later the business had grown 21%, profitability was up 85%, and marketing expenditures were down 20%.

Redefine market boundaries. Think of the definition of book stores for Amazon compared to Borders or Barnes & Noble, or video stores for Netflix and Blockbuster, or cameras for Apple and Cannon.

Reach beyond existing demand. In the late 90’s, only 3% of customers locked in guaranteed income from annuities. The market appeared to be 80 direct competitors fighting over a tiny market, until Fortis Financial invented a new way to deliver this feature. Now about 25% of annuities are purchased with the feature Fortis invented. The company that bought Fortis captured the biggest share by far – worth billions of dollars.

Summary

Strategy is how you differentiate from competitors in ways customers value. It takes strategic thinking, which isn’t a random walk, but a disciplined, step-by-step process.

- Know your customers better than they know themselves. Define what they see as basics, value drivers, irritants and not important, and where the industry does not deliver needed performance. Find out what customers are trying to do.

- Pick one core differentiation strategy that gives you some blue ocean space – map it out.

- Focus on one core competency that will carry you into that blue ocean, then choose a select set of other competencies that enable faster, smoother sailing.

- Use a disciplined process that forces thinking out of the traditional definitions of markets, needs, wants. Anticipate the future.

Sources

¹ Competitive Strategy, Michael Porter, The Free Press, 1980.

² Customer Intimacy and Other Value Disciplines, Michael Treacy and Fred Wiersema, Harvard Business

Review, January-February 1993.

² Customer Intimacy, Michael Treacy, 1996.

² The Discipline of Market Leaders – Choose Your Customers, Narrow Your Focus, Dominate Your Market,

Michael Treacy and Fred Wiersema, 1997.

³ Strategy Pure and Simple II, Michel Robert, McGraw Hill, 1998.

⁴ Blue Ocean Strategy – How to Create Uncontested Market Space and Make the Competition Irrelevant,

W. Kim Chan and Renée Mauborgne, Harvard Business School Press, 2005.