Great Leaders Series Overview

Why Have Businesses Stopped Doing This?

We believe for a business to flourish, the complexity of leadership, strategy and execution must be simplified. The ability to simplify complexity is an extraordinarily powerful competitive advantage.

So we wrote a book, and we’re providing it to you (free) — offering many of the simplifying practices we’ve found that work — through research and leading over 30 businesses to several billion dollars in new, profitable growth. It will show up in your email one or two times a week, in easily consumed parcels. If you miss a chapter, go to: http://www.switchtrackgroup.com/category/e-book-snippets/ We live in a world of too much information — too much content. There are hundreds of great ideas competing with each other, but it is tough to put it all together. Compartmentalized information abounds. Complexity is exploding. Or at least the sheer quantity of information and options are growing so fast it looks like complexity and has the same effect. As a leader, have you ever wished for a simple master crib sheet? – a short list of the things that really do drive business and leadership success, the order in which they should be tackled, and how to know if the performance of these is what’s needed. We have. And many of the leaders we speak with, small business or large, have too. The amount of research that defines best practices is exploding. But, is their Best Practice — right for — your Best Practice? The chase to improve every best practice has become THE focus – as a result, leaders today have shifted from strategic leadership to selecting among tactical improvements. The focus for leaders has become choosing among the explosion of “best practice tactical programs” to improve business in a step-wise fashion. The impetus for this book came from a partnership with Bill Howe, founder of Growth Engine Group and our mutual desire to provide leaders a single, simple-to-use tool that could measure the strength of all critical success drivers simultaneously. We wanted to provide leaders a crystal clear one-page quantitative assessment of what is working and not working in their business so they can accurately focus their attention on the right things in the right order. And it needed to be intuitively “right” to users – “Oh, this makes a lot of sense.” We wanted users to be able to easily explain what drives success to others. This book is based on real experience and research in the real world – the findings that keep coming up again and again that have been proven to create stronger results – the enduring drivers of business health. We hope you’ll find it useful. Best regards, Craig Britton and Gary Scott Partners, SwitchTrackOverview

Simplifying Complexity is Powerful

#1 Can You Say, “My business is flourishing”?

#1 Can You Say, “My business is flourishing”?

flour·ish v. 1. To grow well or luxuriantly; thrive. 2. To do or fare well; prosper. 3. To be in a period of highest productivity, excellence, influence.

How would it feel when asked, “How’s your business?” and you could reply, “Flourishing.” Take a moment…think about it.

Can you say your business is flourishing? When we ask business leaders, most would love to have a thriving business, most don’t, and most don’t think it’s possible. In fact, expectations have sunk to all time lows. That is, except those who have chosen to build a flourishing business.

to build a flourishing business.

More #1

Pursuing business health is a lot like pursuing personal health. In other words healthy businesses focus on the big drivers of health, not just a series of simplistic solutions.

Personal Story: Several years ago I went to my doctor for a physical and found I had high cholesterol – the bad kind. My doctor wanted to prescribe medication. I wanted to try changing my diet first, asked for dietary advice, and got none (no vested interest in the solution.) The common wisdom concluded the best opportunity was to reduce high fat foods. I did. No effect on my cholesterol.

So I started the medication but had a hard time staying on it. (I don’t like taking medication in general, its expensive and I had no way of measuring my cholesterol every day. I couldn’t see progress and stopping had no visible consequence.)

Then my wife and I watched a documentary on how foods affect health. The science illustrated, in very easy to understand terms, how different big food groups interact with our bodily systems to effect health.

The next day we changed the way we eat. After 6 weeks, my cholesterol returned to healthy levels. My weight dropped by 16 pounds. My enjoyment of food has not diminished in the least. And cooking has proven to be no harder than before.

What happened that was different? We suddenly knew what would work … and WHY.

Along the way, the “tactical” fix – medication – wasn’t even needed. New habits were substituted for old ones, without changing the fundamental work to plan and prepare or the enjoyment of our food.

Taking medication is a very popular, best practice solution to high cholesterol. But it’s tactical because it is directed at reducing cholesterol, not improving health. In fact the way the medicine is used is generally to counteract bad eating habits that continue. I no longer tried to overcome bad eating with a simplistic “best practice” – taking medicine, reducing fat, etc.

I achieved clarity about WHY and HOW foods impacted my health. Not only that, it’s been enjoyable and at the end of the day I’m proud of my health and the fact that pants I haven’t worn for years now fit.

Chasing best practices in business often works the same way. If you aren’t making an enduring commitment to an overall set of underlying effective principles, or “drivers”, of business health, a best practice program may reduce the “cholesterol” in your business, but not fundamentally change its overall health.

Over the next weeks we’ve decided to start a discussion about this, and share what we’ve learned about underlying principles, or drivers, that put businesses on the path to being healthy and flourishing, not just a tactically well-medicated one on a low fat diet. We hope you’ll join us in that discussion. This is part #1 in a series — but is also intended to stand alone.

Simplifying Complexity is Powerful

#2 Can You Imagine Success Without These?

#2 Can You Imagine Success Without These?

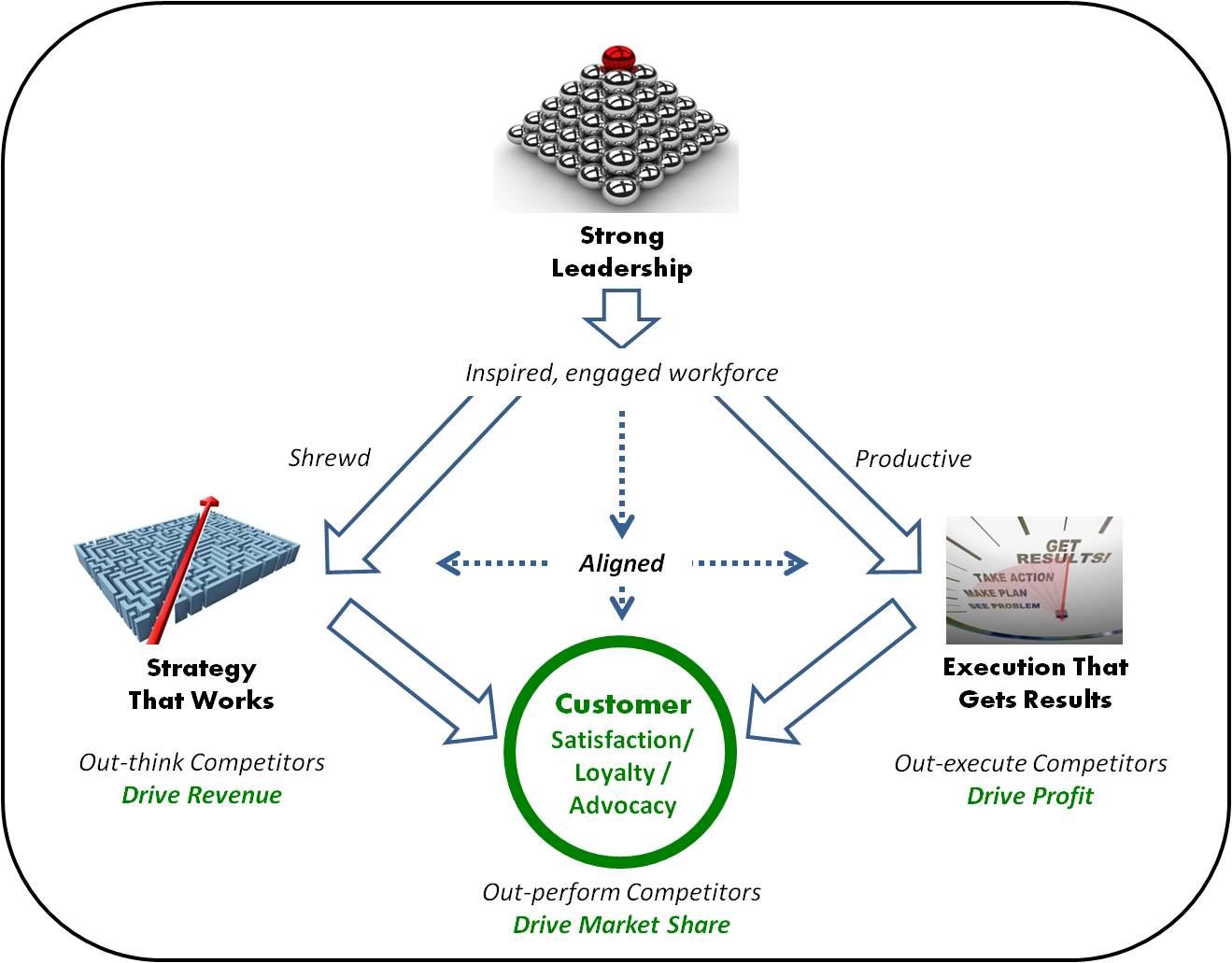

Can you imagine a business being successful without these three factors being right?

Leadership, Strategy and Execution.

So what? You probably knew this, too. The challenge is not what great leaders know, but how difficult it is to say exactly what comprises these three, how they interact with each other, and the order in which issues across the company in these three drivers need to be addressed.

We will explain each of these in detail, but for now let’s start with a basic idea of what each encompasses and why these so important.

Leadership focuses on ensuring people know WHY the business is important, WHY working there is important, WHY individual people are important, and WHY doing the right thing is important. Through this they are able to attract and keep great people, and keep them committed through good times and bad. They create energy, persistence and will in the organization. It gives them the skill and courage to make good, if tough decisions. It maintains the focus on customers. It becomes the example that the organization will follow. It is the result of disciplined people. It is the ability to inspire and engage a company’s workforce and anyone else the business needs to succeed.

Strategy is the direction the business will relentlessly focus on that anticipates the future, differentiates it from competition in ways targeted customers value, and makes it increasingly difficult for others to duplicate or derail. It determines WHERE the business will compete, and HOW it will build a competitive advantage. It is the shrewdness of the organization and its competitive effectiveness in its chosen market place that drives revenue. Strategy drives revenue, and comes from disciplined thought. It is the ability to outthink competitors.

Execution is the ability to get the most important things done well. Execution is the productivity of the organization. It drives customer satisfaction with your quality, price, and value. It creates customer loyalty and advocacy. It creates the right actions through WHO will do WHAT by WHEN. Execution is the driver of productivity and therefore, profit, and is the result of disciplined action. It is the ability to out-execute competitors.

Together these create customer loyalty and advocacy, which drives market position. Together, these create the ability to outperform competitors. Competitive advantage.

Leadership, strategy and execution are not states of being. To be a strong leader, to create a strategy that works, to execute well is not a one-time step. These are the result of a series of many ah-has, decisions and actions in a conscious and consistent direction. Jim Collins in his book Good to Great describes this as the flywheel effect². The more the learning, decisions and actions of the organization move in the right direction (discipline), the harder it is to undermine the strength of leadership, strategy and execution (competitive advantage.) This is how they work together.

How the Three Success Drivers Work Together¹

Strong leaders also understand that there is a vital order to pursuing the development of leadership (disciplined people), strategy (disciplined thought) and execution (disciplined action): Leadership must come before strategy, and strategy before execution.

Strong execution without the guidance of a strategy that works simply rides down the wrong track at a faster pace. It is impossible to achieve strong execution without also having a committed organization created through strong leadership. And finally, it is very difficult to pursue the disciplined thought that an effective strategy requires without strong leadership clarity — defining why.

The Right Order is Essential

Most everyone today is starts with and gets stuck in execution, on a constant treadmill to improve execution enough to overcome hurdles in leadership and strategy. Is my manufacturing lean enough? Is my website and social media right? Are my sales people effective? Should I install and ERP (Enterprise Resource Planning) software? Am I making quarterly goals? Do I need new marketing materials?

The list is endless and the chase for improvement endless. Order is important. Execution improvement initiatives rarely get promised (or hoped for) results without the strength in leadership and business strategy.

Of course, now the hard part begins. What exactly comprises strong leadership, a strategy that works, and execution that gets results? How do I build strength in each of these? Where should I start?

Ask a dozen successful leaders … get a dozen different answers. Ask them once, get part of the answer. Ask them again, and get a bit more. This is what they intuitively know, but can’t tell you … or at least have a great deal of difficulty laying it out in a way that others can see can see, understand and act on.

This is part #2 in a series — but is also intended to stand alone. Coming up: part #3 – we’ll show you the whole picture – What strong leaders can’t tell you – the few critical success factors in leadership, strategy and execution. We hope you’ll join in!

Simplifying Complexity is Powerful

References

¹ © 2012 Bill Howe. The leadership equation and model was developed by Bill Howe, founding partner of Growth Engine Group. All rights reserved. ² Good to Great – The Flywheel Effect, Jim Collins, Fast Company, October 2001

#3 Why Have Businesses Stopped doing this?

Great Leaders Series Overview

#3 Why Have Businesses Stopped Doing This?

We believe the complexity and sheer volume of “step-wise” business improvement has led companies to ignore the larger strategic health in their business (Focusing on the What – Why and How —the underlying drivers of real success).

We believe for a business to flourish, the complexity of leadership, strategy and execution must be simplified. The ability to simplify complexity is an extraordinarily powerful competitive advantage.

So we wrote a book, and we’re providing it to you (free) — offering many of the simplifying practices we’ve found that work — through research and leading over 30 businesses to several billion dollars in new, profitable growth. It will show up in your email one or two times a week, in easily consumed parcels.

If you miss a chapter, go to: http://www.switchtrackgroup.com/category/e-book-snippets/

We live in a world of too much information — too much content. There are hundreds of great ideas competing with each other, but it is tough to put it all together. Compartmentalized information abounds. Complexity is exploding. Or at least the sheer quantity of information and options are growing so fast it looks like complexity and has the same effect.

As a leader, have you ever wished for a simple master crib sheet? – a short list of the things that really do drive business and leadership success, the order in which they should be tackled, and how to know if the performance of these is what’s needed. We have. And many of the leaders we speak with, small business or large, have too.

The amount of research that defines best practices is exploding. But, is their Best Practice — right for — your Best Practice? The chase to improve every best practice has become THE focus – as a result, leaders today have shifted from strategic leadership to selecting among tactical improvements. The focus for leaders has become choosing among the explosion of “best practice tactical programs” to improve business in a step-wise fashion.

The impetus for this book came from a partnership with Bill Howe, founder of Growth Engine Group and our mutual desire to provide leaders a single, simple-to-use tool that could measure the strength of all critical success drivers simultaneously. We wanted to provide leaders a crystal clear one-page quantitative assessment of what is working and not working in their business so they can accurately focus their attention on the right things in the right order. And it needed to be intuitively “right” to users – “Oh, this makes a lot of sense.” We wanted users to be able to easily explain what drives success to others.

This book is based on real experience and research in the real world – the findings that keep coming up again and again that have been proven to create stronger results – the enduring drivers of business health.

We hope you’ll find it useful.

Best regards,

Craig Britton and Gary Scott

Partners, SwitchTrack

Simplifying Complexity

#4 Why Chasing Productivity Can Be A Trap

#4 Why Chasing Productivity Can Be A Trap

Hugh ran a $75 million manufacturing business. He’d been running this business for over 12 years. He worked long hours to keep the business on track, through many productivity improvement initiatives: customer acquisition campaigns and marketing productivity, pricing, sales effectiveness, employee management, and procurement, manufacturing and distribution cost reduction. Despite decades in the business, products and quality equal to the leading competitor, and a well known brand, the business was losing revenue and market share, and profit was barely staying even. Why?

As a kid, did you ever try to run up the down escalator?

Race up until you make it to the top – or at least close to the top. Do you ever think of your business as an escalator? It is. Watch the video – it’s a hoot! Does the video remind you of running a business today?

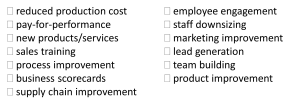

In a business, each step of the escalator is just like the initiatives Hugh, in the above real story, was working on. They are necessary to staying in the game. The initiatives Hugh worked on included:

But think about it … is your business an up escalator, where the movement of the escalator multiplies the distance of each step … each initiative?

Or does it feel like you’re trying to run up the down escalator, where it takes a lot of rapid, successful steps just to stay in place much less make it to the top. In other words, a lot of effort and expense without the return needed to truly lift the business up. And forbid the thought that you stop, or the business begins to slide.

The real question is what determines the direction of the escalator itself, so that each step, each program, is riding on upward momentum, rather than trying to overcome downward momentum? The direction of escalator is determined by strategic drivers – those things where it is possible to do better than competitors and makes a big difference to customers. Productivity drivers will not change the direction of the escalator, but can accelerate progress if the escalator is travelling in the right direction.

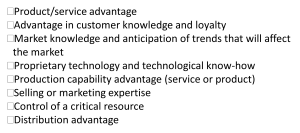

It’s a very different list. These are some of the strategic drivers that have the power to change the direction of the escalator.

No company should try to be great at all of them. The strongest companies pick one driver as their primary focus, work on two or three others that are critical to success, and do “OK” on the others.

Hugh eventually was asked to leave the business. The new leader, Tom, did some exploration and discovered that Hugh had made a lot of progress in productivity, but had not really challenged the business to focus on a specific strategic driver. The business had really focused on keeping up with what the industry was doing. With new focus on being better than competitors in just three key strategic drivers (customer knowledge supported by marketing/sales expertise and information technology know-how) in two years the business profit had almost doubled and revenue growth outpaced every other competitor in the industry.

Hugh fell into the productivity improvement trap. Productivity improvement programs, which are more contained and likely to promise more immediate results, often become the focus of leaders and their organizations Look what happened to this business and look what happened to Hugh. The choice to revitalize a business by challenging it to focus on building strength in strategic drivers can understandably get lost. There is always the feeling that if you stop running up the steps, that the slide down will begin.

Strategy and “strategic drivers” are vague concepts for most leaders and perceived to be a big risk if they require change. And tackling strategy often uncovers weaknesses in a business – which no leader with any tenure really wants to do. But we’ll show you in the next series of articles that improving strategic drivers isn’t really any more difficult than implementing productivity initiatives, and in fact, reduces risk, builds support, and makes life overall a lot easier!

Are you attempting to go up the down escalator? Do you still want to do this? Watch the video. Try running up an escalator already moving upward. Big difference.

If you’re curious about the strength of the key drivers of advantage in your company, we offer a free on-line assessment that provides immediate scoring of the strength of your advantage. Have each team member complete the assessment (it takes about 5 minutes) and then discuss the results. It will help you and your team determine if a look at your strategic drivers could help your business performance.

Simplifying Complexity is Powerful

#5 Some BS: The World Is Moving Too Fast

#5 Some BS: The World is Changing Too Fast to Build and Sustain a Competitive Advantage

I recently read an article in Harvard Business Review. The point of the article is that creating a long term competitive advantage is almost impossible today because the world is changing too fast. This is, to sum it up in two letters, BS.

I suppose it depends on how you define “long term”, but for the purposes of this argument, let’s say long-term is at minimum ten years.

Blockbuster, the video rental retail giant, built a long-term competitive advantage compared to Hollywood Video and just about any other video rental brand, over 20 years. More stores. More purchasing power. And a power brand in a growing video rental market. Then poof! Almost overnight they were closing stores and declared bankruptcy.

Change happens and change happened fast. Was it too fast for Blockbuster to sustain their competitive advantage. Nope. So what killed them?

Change happens and change happened fast. Was it too fast for Blockbuster to sustain their competitive advantage. Nope. So what killed them?

Blockbuster opened its first store in 1986. In 2004 it was the world’s largest video and game rental retailer. In 2005 it initiated on-line video rental. In 2007 a new CEO was hired, the CEO of 7-11, a large convenience store chain. Blockbuster declared bankruptcy in 2010.

Netflix launched its video rental website in 1998. The idea of Netflix came to the founder when he was forced to pay $40 in overdue fines after returning Apollo 13 well past its due date. In 2000, it adopted its flat fee, unlimited rentals without due dates. Also in 2000, guess what? The company was offered for sale to Blockbuster for $50 million. Blockbuster declined.

Netflix launched its video rental website in 1998. The idea of Netflix came to the founder when he was forced to pay $40 in overdue fines after returning Apollo 13 well past its due date. In 2000, it adopted its flat fee, unlimited rentals without due dates. Also in 2000, guess what? The company was offered for sale to Blockbuster for $50 million. Blockbuster declined.

What killed Blockbuster? Not understanding what truly drives sustainable competitive advantage in a changing world – the ability to anticipate, innovate and adapt. Blockbuster defined its competitive advantage in terms of traditional retailing. In fact it was so embedded in its historical advantage, although losing share to Netflix’s “virtual store”, it hired a retail convenience store CEO to turn the company around! It had plenty of time to change its business model. The world did not move too fast. Blockbuster failed to understand what, in today’s world, is the platform for a sustainable competitive advantage: the ability to step outside habitual views of the world, and build a culture of anticipation, innovation and adaptation.

Why did this happen? Try a simple 30 second experiment I learned from Jean Nitchals:

Stand up. Stretch your arms out to your side. Stretch them toward the ceiling. Now bring your hands down in front of you to belt level and clasp them together, similar to those in the picture to the right.

Which thumb is on top?

Now stretch again the same way. Then clasp your hands together, but this time with the other thumb on top. How does it feel?

Now stretch again the same way. Then clasp your hands together, but this time with the other thumb on top. How does it feel?

We all have habits which feel very natural and comfortable. When someone asks us to change that habit, it feels very uncomfortable. We resist making the change.

Companies are very much the same. The stronger the business habit (a tradition of doing things or viewing the world the same way), the harder it is to change the habit.

Changing old ways can feel overwhelming in its size or complexity, even if there is some recognition that it’s needed. Past success can create arrogance – past success will continue into the foreseeable future…we are so strong that nothing can really hurt us. Or there may be recognition that the business needs to adapt, but toward what is unknown. Often all three are in play to some degree.

It is not that companies today cannot create a sustainable advantage. It’s that a foundational component of competitive advantage has become more dependent on the “soft” skills of an organization (leadership, adaptability, anticipation, collaboration, decision making, employee engagement, culture, performance management), supporting other “hard” skills (quality, convenience, technology, unique process or cost, distribution, product/service development and so on).

Having an advantage in soft skills, while required today, is also not enough. A sustainable competitive advantage requires the combination of hard and soft skills.

A restaurant may be able to quickly adapt to rapidly changing food trends and serve excellent food at a competitive price. But if it does not have the capability to deliver good service or keep great staff, will it truly have a competitive advantage? Probably not.

Competitive advantage can be sustained. The trap is operating as though yesterday’s competitive advantage does not require adaptation to changing circumstances. The longer a historical competitive advantage has been held, the more “habitual” it has become.

Those who failed to see this are numerous. But so are those who have successfully adapted. Look at Intel, who has sustained their advantage in one of the most rapidly changing industries we can imagine. Their advantage is the ability to look forward…to anchor their energy in building a future, not sustaining a past.

As my friends Nancy Burke and Marg Penn would say, “Define yourself not by your past, but by the future you want!”

Simplifying Complexity is Powerful

#6 I'll Bet This is Missing in Your Business Strategy --- Why

#6 I’ll Bet This Is Missing in Your Business Strategy – “Why”

A true story: At a very well known manufacturer, there was a line worker in one of the company’s plants. The job, as explained to her, was to install a specific part as part of the assembly of a larger component. She had no idea what the part she installed did or what the component she contributed to would ultimately become.

One day when visiting, someone asked her how it felt to build parts for our military’s helicopters. She was stunned. She had no idea. Suddenly, coming to work felt a whole lot different. She understood that the company was there to design and make the absolute best quality components needed to make a helicopter perform in combat. It felt important. She looked at her job with pride, not boredom. She came to work with the attitude that every piece she installed had to be exactly right. If she saw something wrong, she did whatever it took to make it right.

Why doesn’t this company make sure she knows why the company exists?

This is a huge financial question. They have everything to lose if their components are flawed.

Many research studies* have found that between 60% of employees on the low side, and up to 85% on the high side, do not understand why the company in which they work exists (beyond making money), where the company is trying to go and why, and why it believes it can get there. This is despite the fact that 60% of employees have just experienced big changes in their company, and another 28% anticipate big change.

People are hard-wired to solve problems. We crave knowing why. Our brains are built that way. The more important the problem is perceived to be, and the more it creates emotional attraction to solving it, the more engaged and committed people get. The more clear and committed employees are, the better company’s perform. (see the statistics below)

Why don’t companies get people to understand and support why they exist?

Lack of compelling clarity. A CEO of a Fortune 500 food company once rolled out why the company exists: To be the best food company in the world. Employees immediately asked, “What does this mean? How will we know when we have achieved this?” The response, “We’ll know it when we see it.” The employee’s reaction, of course, was to dutifully hang the wall plaque and promptly talk with each other about how stupid it was. This company was acquired a short time later.

The CEO and the President of a very large financial services company formed from a merger, sat down with over 100 key leaders to articulate the mission and vision for the company. Two and a half hours and seventeen pages later, no one in the room had a clue what they were talking about, nor could they repeat it to their employees. To say the least, trust in the leadership and commitment to the company did not improve that day.

Belief that it’s not important. Two owners of a mid-size services firm began to create a new strategic plan for growing the company. They flat out resisted creating a “mission” statement because their experience was a lot like those of the employees above. But they conceded to the facilitator working with them. When they rolled out the new strategy and a clear, compelling mission, the employee feedback? “The mission of the company is something we can really get behind, and critical to understanding the strategy.” The owners almost fell off their chair.

Confusing what and why. Simon Sinek describes Apple’s mission as “challenging the status quo and thinking differently in everything we do.”³ This is what customers would truly miss if Apple were suddenly to disappear off the face of the earth. As Steve Jobs summed it up, “Man … should be above systems and structures, not subordinate to them.”⁴ This is why Apple exists. This is the driving foundation of their strategy. It is what they do better than anyone else. Apple’s employees believe this totally. Apples customers believe this totally. Strategic glue.

Contrast this with the Asus mission statement: “As a major player in the IT industry, ASUS’ corporate mission is to provide innovative IT solutions that empower people and businesses to reach their full potential. ASUS’ philosophy behind product development—which is to accomplish the fundamentals well first before moving forward—has resulted in a dependable backbone of computer components … such as motherboards, graphics cards, and optical storage devices.⁴ It describes their products and services… what Asus does. There is nothing compelling in which to engage and believe.

Assuming everyone knows. What is clear to the CEO and leaders often goes unsaid, or it’s assumed that once said, everybody got the message, understood it, and remembers it. Or it just gets lost in the crush of to-do lists that are way too long. Sound familiar. Remember, it’s likely that seven out of every ten employees don’t know.

To build a compelling why, try completing these statements:

- If our customers believe _____________________, then we are the right company for them.

- If our employees believe ____________________(how we make a difference), then they are probably the right employees for us.

- If we were to disappear tomorrow, our customers would not find another company that believes _______________________ , which is exceedingly important to them.

- Define, in this order:

- What services/products you offer.

- How the capabilities you have allow you to offer services/products better than any competitor. The most common are customer knowledge, proprietary technology or process, market knowledge, marketing and sales capability, control of a scarce resource, control of distribution (location, channel, method), production capability (lowest cost, capacity). One capability is the primary driver of your difference.

- Why customers want the difference you offer compared to competitors. Use the “5 whys” technique.

Some Performance Statistics

Engaged organizations grew profits as much as three times faster than their competitors. They report that highly engaged organizations have the potential to reduce staff turnover by 87% and improve performance by 20%.⁵

Across all companies, 49% of employees are not engaged plus another 18% are actively disengaged (67% total). Companies with world class engagement average 26% not engaged and only 7% actively disengaged (33% total).⁶

Between 1988 and 1998, seven out of eight companies in a global sample of 1,854 large corporations failed to achieve profitable growth. 90% of these companies had detailed strategic plans. 95% of employees in these companies were unaware, or did not understand, its strategy.⁷

Sources:

* http://www.forbes.com/sites/johnkotter/2013/07/09/heres-why-ceo-strategies-fall-on-deaf-ears/

* http://hbr.org/2005/10/the-office-of-strategy-management/ar/1

* http://www.businessweek.com/managing/content/mar2010/ca2010035_940515.htm

¹ http://www.forbes.com/sites/johnkotter/2013/07/09/heres-why-ceo-strategies-fall-on-deaf-ears/

² http://www.businessweek.com/managing/content/mar2010/ca2010035_940515.htm

³ http://www.ted.com/talks/simon_sinek_how_great_leaders_inspire_action.html

⁴ http://www.businessinsider.com/apples-new-mission-statement-2013-8#ixzz2gZmSsbeJ

⁶ http://www.gallup.com/strategicconsulting/121535/Employee-Engagement-Overview-Brochure.aspx

⁷ http://hbr.org/2005/10/the-office-of-strategy-management/ar/1

#7 What's a Strategy and How Do I Get One?

#7 What’s a strategy and how do I get one?

Every business that succeeds has developed clear differentiation from every other business that competes for the same customer dollar to solve the same problem – differentiation that customers value. It doesn’t matter if you are a one person shop or a giant multi-national corporation.

So, how could a declining, pure commodity business, flour, in a declining category with a poor market position and cost disadvantage differentiate from competitors and achieve revenue growth of 21%, profit increases of 85%, all while reducing spending … in two years?

declining, pure commodity business, flour, in a declining category with a poor market position and cost disadvantage differentiate from competitors and achieve revenue growth of 21%, profit increases of 85%, all while reducing spending … in two years?

For many, many businesses, this is essentially the challenge they face and the performance they want. Developing a strategy that works is the solution. But what is a strategy and how do I get one?

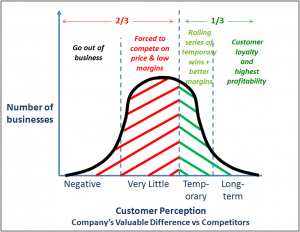

Lack of a compelling difference is the norm.

At least two thirds of businesses have little difference from their competitors.

This is good for customers. Quality is forced to remain high, while price is forced to rock bottom … or further.

And it is a trap that becomes harder and harder to escape.

The business puts more effort in to lowering costs. Investment declines. Innovation declines. There’s a trend toward lower cost people. Best employees leave. Opportunities are chased that stretch resources and dilute focus even more.

Then what happens? Along comes a game changing competitor, with a truly valuable difference, forcing other businesses even further to the left, toward negative territory. Or the big three win, crushing smaller competitors trying to compete on price without any advantage of scale.

The real question is, “Can companies get out of the trap of no or low differentiation, and if so, how?” The answer is, “Yes!” for most businesses. To understand how, it is necessary to understand the three steps of differentiation.

But a note before we go there. A lot of companies confuse go-to-market strategies with their business strategy. A business strategy is how you develop the underlying competitive advantage of your products or services and company. Go-to-market, or marketing and sales strategies, define how you will get and keep your prospective customers attention and com municate your competitive advantage.

municate your competitive advantage.

In real life, Apple’s advantage is innovation. They also have an excellent way to communicate the advantage of that innovation.

The three steps covered here are about business strategy – developing the business advantage that differentiates a business from competitors – that forms the foundation of what you talk about in your marketing and sales.

The Three Steps of Business Strategy

Step 1 – Choose and know your customer.

Businesses must clearly define the customers it wants to serve. Know who they are, where they are, what they want solutions to enable them to do, now and in the future, and why your reason for being resonates with them.

There is a particular perspective that is very helpful: when providing any solution (product/service), understand if your target customers see the solution(s) as:

1) expected of all competitors in your industry (if you don’t perform well on these expectations, providing great value on other issues that can differentiate the business won’t matter). Many businesses continue to focus on improving basics as the basis for differentiation. Over and over again it’s been shown that improving satisfaction with basics past a certain point has no value to the customer.

2) a true value driver – a solution to an issue that is important to customers and the industry has not solved well. These form the core opportunities to differentiate.

3) taking away an irritant. Eventually these may become value drivers, but not yet.

4) a solution to a problem that is unimportant.

You must also understand how customers perceive your business performance on these issues relative to other competitors, and how perceptions change.

Customer’s views of an issue, and your value, change over time: when value driver issues get solved by the majority of the industry, they become basic – expected. And customers are not very good at saying what they want in the future.

This is where a lot of businesses get in trouble, believing their competence in delivering a value driver of the past will continue to generate a valuable difference from competitors in the future. Not so. Expectations and issues change.

And it gets worse. If businesses ask customers if they are satisfied, customers lie about their satisfaction. Of customers who report they are “satisfied” with a product or service, 60% are actively looking for an alternative.

Focus on understanding what your customers are trying to do.

Step 2 – Choose your core differentiation strategy that allows you to create “uncontested market space.”

Choose the one foundational differentiating strategy that you can (or will) do better than any other competitor.

The grand masters of competitive strategy, Michael Porter¹, Michael Treacy and Fred Wiersema², found there are only three core foundational strategies from which to choose. These have truly stood the test of time.

The three are: 1) deliver consistently good quality at the lowest operational cost to the customer (Walmart), 2) deliver highest quality/ innovation solutions to the customer (Tiffany and Apple), or 3) deliver the most customer intimate solution to the customer (customization different for very small groups or individual customers (Amazon).

Many business leaders ask, “Why can’t we pursue more than one?” Great question, because focus on one strategy can lead to advantage in another core strategy. But not because a business is truly able to focus on pursuing two at the same time. Let’s look at an example:

Progressive insurance pursued a core differentiation strategy of service quality and innovation. By focusing on innovative ways to solve a big customer problem: reducing the time the industry took to pay claims. Through innovation they were able to reduce claim payments to customers from 40 days to 1 hour. Adjustors at an accident could offer the customer the choice of receiving a check on the spot or having Progressive take the vehicle to one of their prescreened repair shops for the customer where the repair would be guaranteed.In the process, they dramatically reduced claim fraud, paperwork and repair errors, giving them a cost advantage compared to other insurance companies. They could reflect much of this in price, while still maintaining higher margins than competitors.

They would never have achieved this if they had not single mindedly pursued dramatic improvement in service quality – reducing the time to pay claims from 40 days to 1 hour. Innovation through new technologies, innovation in redesigned roles and responsibilities throughout the claims process, and reinventing how they implemented repairs allowed Progressive, as a byproduct, to also achieve a cost advantage.

Step 3 – Choose your core competencies that allow you to differentiate.

Michel Robert, in Strategy Pure and Simple³, makes the distinction between strategic thinking and strategic planning. Strategic thinking allows a business to choose the one strategic driver or core competency that will enable it to be best in its core differentiating strategy. It’s not easy to choose. Robert does a great job demonstrating there are ten from which to choose³. Great companies choose one to be the driver, and 1-3 others that are supporting competencies.

- Product/Service Driven: Excel in a single product or service class. Requires excellence in product or service innovation. (Boeing – aircraft; Michelin – tires).

- User or Customer Class Driven: Excel in serving a single, well defined set of end users who share multiple needs. Requires excellence in market research about users and the ability to create loyalty through development of many solutions to serve those customers (Johnson & Johnson – doctors, patients, nurses, mothers; AARP – adults over fifty).

- Market Type or Category Driven: Excel in a specific market place or type. Requires excellence in market research about the market and the ability to create loyalty by delivering a wide variety of solutions to serve that market in different ways (Disney – entertainment for families; American Hospital Supply (hospitals).

- Technology Driven: Excel in a basic hard technology or soft technology (know how). Requires excellence in R&D and marketing of technology. (Intel – microchip design and manufacturing; Lean Masters Consulting – lean manufacturing; 3M – polymer chemistry, manufacturing and application).

- Production Capability or Capacity Driven: Excel in production capability or capacity which requires significant investment and which competitors have difficulty duplicating. Requires excellence in manufacturing/plant efficiency and substitute marketing to replace existing vendors (SW Airlines – Low-cost air service substituting for bus service; 3M – Sticky pad manufacturing).

- Distribution Method Driven: Excel in a unique or distinctive approach to moving tangible or intangible things from one place to another. Requires excellence in distribution technologies, processes and innovation. (Walmart – low cost distribution and positioning of consumer products; Twitter – electronic messages; UPS – physical packages.

- Sales or Marketing Driven: Unique or distinctive method of selling to customers. All opportunities it pursues must use this sales/marketing method. (Amazon – on-line shopping; Mary Kay – door to door.)

- Natural Resource Driven: Excel in the discovery and exploitation of a natural resource. (Mosaic – potash; Exxon – oil and gas; DeBeers – diamonds).

- Return or Profit Driven: Excel in maximizing the level of return or profit. Requires excellence in portfolio selection, acquisition, divestiture. (Berkshire Hathaway – investment in multiple unrelated businesses).

- Size or Growth Driven: Excel in driving growth and size for its own sake. Requires excellence in customer acquisition and retention to a specific platform. (Facebook – dominate facilitating friend networks globally; Google – dominate availability of search information.)

Blue Ocean strategies.

The purpose of choosing to focus on a core differentiation strategy and the right strategic drivers is to find a way to compete in uncontested, or at least much less congested, market spaces – what’s been deemed “Blue Ocean.”

The purpose of choosing to focus on a core differentiation strategy and the right strategic drivers is to find a way to compete in uncontested, or at least much less congested, market spaces – what’s been deemed “Blue Ocean.”

Ultimately, the strategy has to be translated into tangible products or services that offer customers what Chan Kim and Renée Mauborgne in Blue Ocean Strategy describe as “exceptional buyer utility⁴.”

There are a number of ways to do this, but the easiest way is to visualize what’s going on competitively to encourage divergent thinking… strategic thinking.

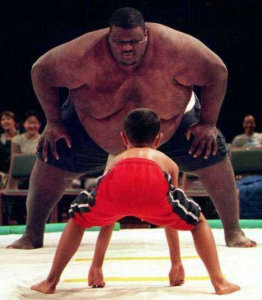

Start by asking, “Are we big or small?

Big players can do things small players cannot, and vice versa. Visualizing what you are up against forces you to ask, “How do I win customers?” You realize the assumed question, “How do I win against a specific competitor by assuming their rules?”, is the wrong one.

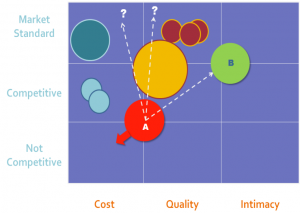

Next, map your market.

Put yourself, the market’s customer segments, and your competitors on a map of the three core differentiation strategies. See how the size of the players compares. See the relative strength of players in each strategy. Find the open space — see the red oceans and the blue oceans.

See the big picture … not the numbers. Pillsbury’s consumer flour business (red circle) was declining 7% per year in a category declining 5% per year, a pure commodity with zero differentiation, a 15% cost disadvantage, and the #3 or 4 position in most regional markets. By shifting to a customer intimate strategy with the core competence to deliver customized recipes to end-users and customized market data to supermarkets that allowed them to grow the category, two years later the business had grown 21%, profitability was up 85%, and marketing expenditures were down 20%.

Redefine market boundaries. Think of the definition of book stores for Amazon compared to Borders or Barnes & Noble, or video stores for Netflix and Blockbuster, or cameras for Apple and Cannon.

Reach beyond existing demand. In the late 90’s, only 3% of customers locked in guaranteed income from annuities. The market appeared to be 80 direct competitors fighting over a tiny market, until Fortis Financial invented a new way to deliver this feature. Now about 25% of annuities are purchased with the feature Fortis invented. The company that bought Fortis captured the biggest share by far – worth billions of dollars.

Summary

Strategy is how you differentiate from competitors in ways customers value. It takes strategic thinking, which isn’t a random walk, but a disciplined, step-by-step process.

- Know your customers better than they know themselves. Define what they see as basics, value drivers, irritants and not important, and where the industry does not deliver needed performance. Find out what customers are trying to do.

- Pick one core differentiation strategy that gives you some blue ocean space – map it out.

- Focus on one core competency that will carry you into that blue ocean, then choose a select set of other competencies that enable faster, smoother sailing.

- Use a disciplined process that forces thinking out of the traditional definitions of markets, needs, wants. Anticipate the future.

Sources

¹ Competitive Strategy, Michael Porter, The Free Press, 1980.

² Customer Intimacy and Other Value Disciplines, Michael Treacy and Fred Wiersema, Harvard Business

Review, January-February 1993.

² Customer Intimacy, Michael Treacy, 1996.

² The Discipline of Market Leaders – Choose Your Customers, Narrow Your Focus, Dominate Your Market,

Michael Treacy and Fred Wiersema, 1997.

³ Strategy Pure and Simple II, Michel Robert, McGraw Hill, 1998.

⁴ Blue Ocean Strategy – How to Create Uncontested Market Space and Make the Competition Irrelevant,

W. Kim Chan and Renée Mauborgne, Harvard Business School Press, 2005.